Exploring Personal Health Insurance Options

Depending on your location, you can purchase health insurance through either a public or private marketplace. There are four distinct types of marketplaces available:

- Federally-facilitated Marketplace. Most states use the federal health insurance marketplace, which is run by the U.S. Department of Health and Human Services (HHS). As of 2021, these states use the federally-facilitated marketplace:

- Alabama

- Alaska

- Arizona

- Delaware

- Florida

- Georgia

- Hawaii

- Illinois

- Indiana

- Iowa

- Kansas

- Louisiana

- Michigan

- Mississippi

- Missouri

- Montana

- Nebraska

- New Hampshire

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- West Virginia

- Wisconsin

- Wyoming

- State-based Marketplace. There are 15 marketplaces are entirely run by the state. If you live in one of these states, you can buy health insurance plans through your state’s marketplace.

- California

- Colorado

- Connecticut

- District of Columbia

- Idaho

- Maryland

- Massachusetts

- Minnesota

- Nevada

- New Jersey

- New York

- Pennsylvania

- Rhode Island

- Vermont

- Washington

- Federally-supported State-based Marketplace. There are 6 states with a federally-supported state-based marketplace. The state is responsible for all marketplace functions but relies on the federally-funded marketplace IT platform.

- Arkansas

- Kentucky

- Maine

- New Mexico

- Oregon

- Virginia

- Private Marketplace. Private marketplaces, like Health Plan Advocates can be run in any state. They offer on-exchange plans (plans available in each state’s marketplace), as well as plans that are off-exchange (plans that are not on the marketplace but are ACA compliant).

Depending on where you live, there could be hundreds of health insurance plans available to you, and almost as many variables you’ll want to compare when you’re choosing the plan that’s best for your situation. All ACA health plans are broken up into different tiers (often called metal levels): bronze, silver, gold, platinum, and catastrophic. Each metal level offers the same level of coverage but differ in premiums and out-of-pocket expenses.

Subsidies

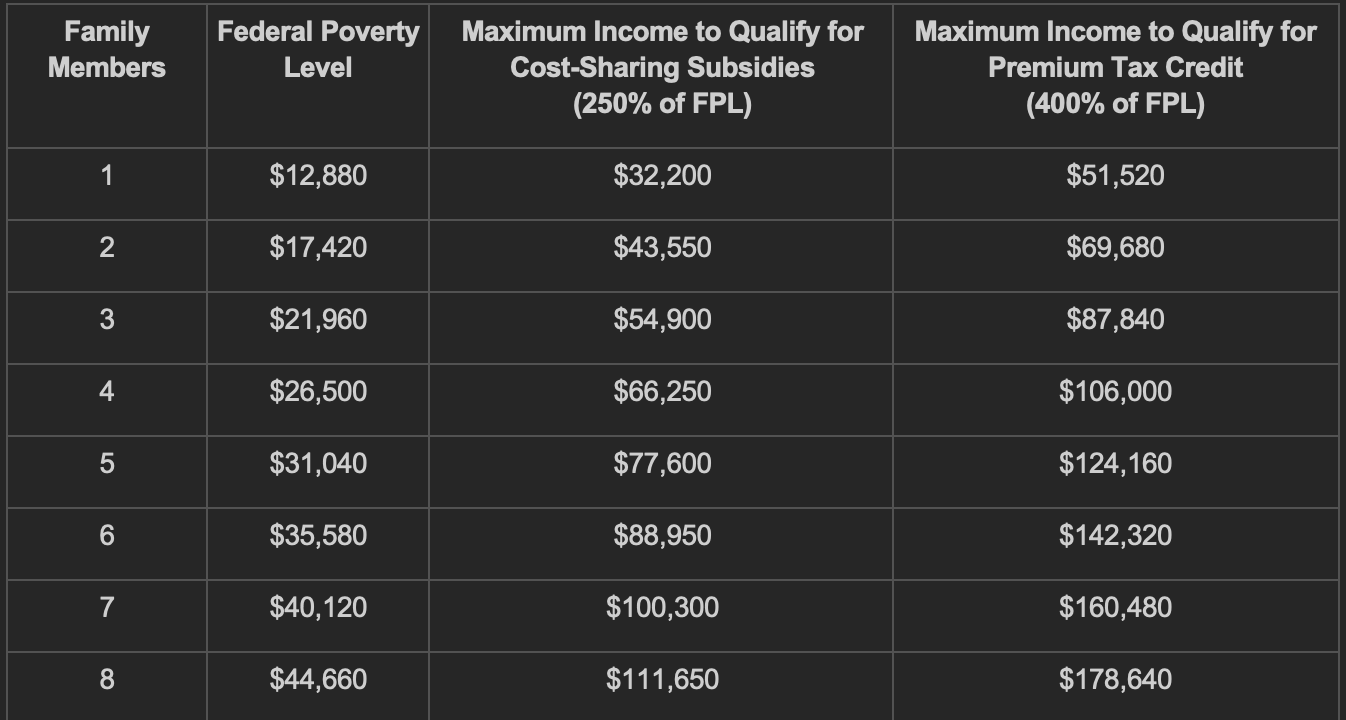

If you’re concerned that health insurance could be too expensive, keep in mind that the government may help you pay for your healthcare costs. Subsidies may be available depending on your income, how large your family is, and the Federal Poverty Level.

There are two different subsidies for which you may be eligible—a premium tax credit or a cost-sharing reduction.

Premium Tax Credit

A premium tax credit may be an option if your income falls between 100% and 400% of the Federal Poverty Level (FPL). You can apply this subsidy to any Affordable Care Act plan. It’s based on a “sliding scale,” meaning the less income you make, the larger the credit.

There are two ways to apply your premium tax credit. Some or all of it can be paid to your insurance provider in advance to lower your monthly premiums, or you can receive the credit when you file your tax return. If you’re married, you must file jointly.

Cost-Sharing Reduction

Cost-sharing reductions (CSRs) are available to individuals and families whose income is between 100% and 250% of the Federal Poverty Level (FPL). CSRs can help reduce out-of-pocket expenses associated with in-network healthcare services, such as copays, coinsurance, deductibles, and maximum out-of-pocket spending limits. These reductions are only available for silver plans, however, there are numerous silver plans to choose from. By taking advantage of CSRs, individuals and families may be able to save money on their healthcare expenses.

Federal Poverty Guidelines